Digital Ad Spending Market Size to Surpass USD 1,483 Billion by 2034 Driven by Video Ads and E-Commerce Expansion

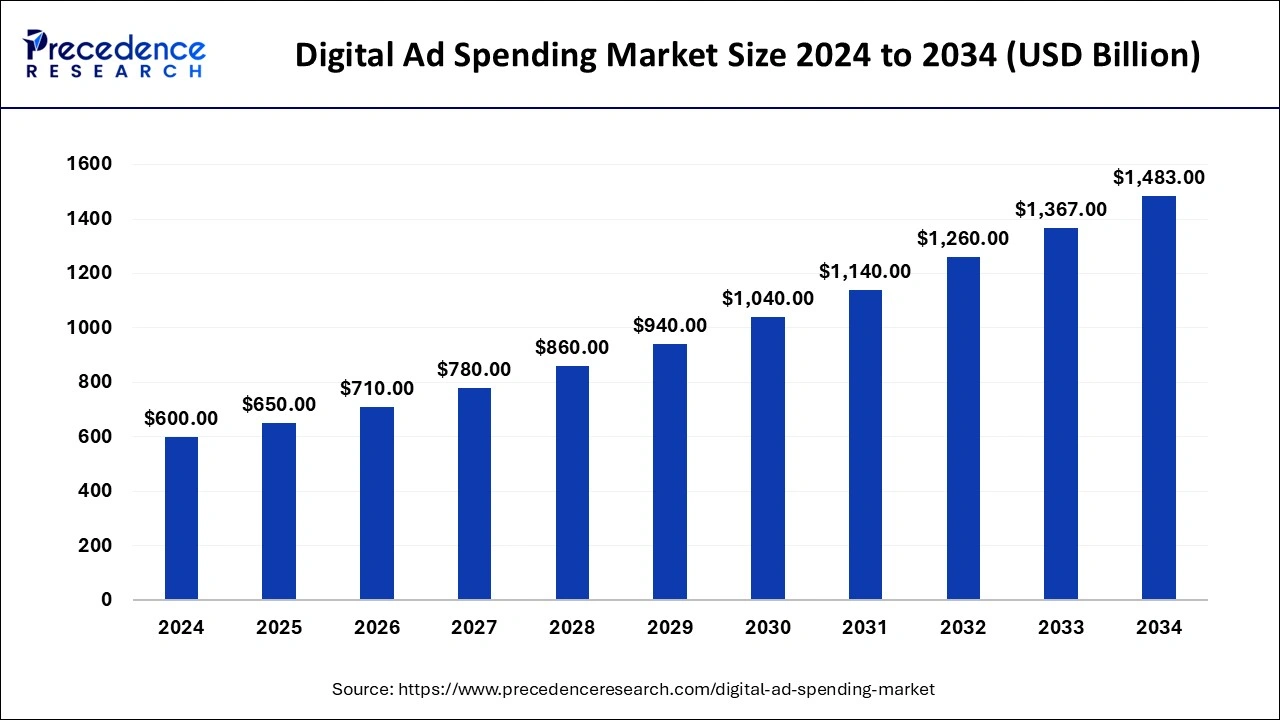

According to Precedence Research, the global digital ad spending market size will grow from USD 650 billion in 2025 to nearly USD 1,483 billion by 2034, with an expected CAGR of 9.47% from 2025 to 2034. Growth is fueled by rising e-commerce adoption, AI-driven targeting, and the surge in video and mobile advertising, making it a cornerstone of modern marketing strategies

Ottawa, Sept. 12, 2025 (GLOBE NEWSWIRE) -- The global digital ad spending market size was valued at USD 600 billion in 2024 and is projected to surpass USD 1,483 billion by 2034. The market is growing at a strong CAGR of 9.47% from 2025 to 2034. The rise in CTV & OTT platforms and increasing spending time on mobile phones drive the overall growth of the market.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1749

Digital Ad Spending Market Key Insights

- In terms of revenue, the global digital ad spending market is projected to cross USD 710 billion in 2026.

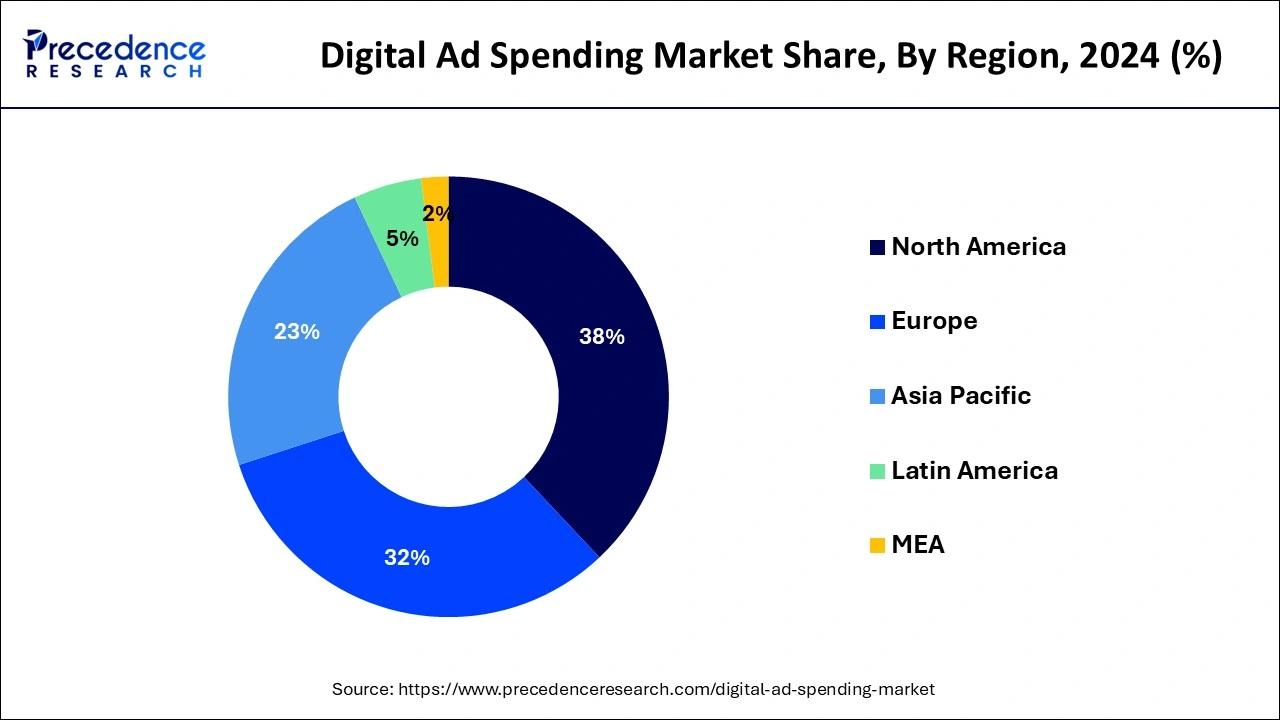

- North America accounted for the major market share of 37.15% in 2024.

- By add format, the video format segment held the largest market share in 2024.

- By end user, the retail segment contributed the highest market share in 2024.

Digital Ad Spending Market Overview

Digital Ad spending is an investment of money for promoting businesses' services and products on digital platforms. Digital platforms like social media, influencer marketing, search engines, mobile apps, and video sites are used for promotional purposes. Digital ads offer benefits like increasing sales, enhancing awareness of brands, and generating leads for businesses. The ad spending is measured using various ways, such as cost per action, cost per click, and cost per mile. Factors like the trend of social media, high adoption of mobile devices, and extensive penetration of the internet support the market growth.

What are the Major Government Support and Initiatives in Digital Ad Spending?

- The Ministry of Information and Broadcasting (I&B) introduced the Digital Advertisement Policy 2023 to empower the Central Bureau of Communication (CBC) to conduct campaigns across digital platforms, including websites, mobile applications, Over-the-Top (OTT) services, and podcasts. The policy establishes criteria for empaneling digital platforms based on their unique user base, ensuring that government advertisements reach a broad and relevant audience. This initiative aims to enhance the dissemination of government schemes and programs in the digital age. (Source: https://www.davp.nic.in)

- In September 2025, the U.S. Food and Drug Administration (FDA) intensified its enforcement of direct-to-consumer pharmaceutical advertising. This includes issuing approximately 100 cease-and-desist letters and thousands of warning letters to drug companies to ensure transparency and accuracy in drug advertisements. The initiative also targets non-compliant online pharmacies and advertisers using social media influencers, aiming to close regulatory loopholes and protect consumers from misleading information. (source: https://www.reuters.com)

- The European Union has adopted Regulation (EU) 2024/900, which introduces harmonized rules for transparency and targeting in political advertising across all EU member states. This regulation complements existing laws like the Digital Services Act and General Data Protection Regulation, aiming to address concerns about the influence of microtargeting in elections and ensuring that political ads are transparent and accountable. This regulation was entered into force on 9 April 2024. (source: https://eucrim.eu)

- Australia's National Digital Transformation Strategy, launched in 2021 and updated in 2022, outlines a comprehensive approach to digital governance, including the regulation of digital advertising. The strategy emphasizes the importance of digital literacy, data privacy, and ethical standards in digital advertising, aiming to create a balanced and inclusive digital economy that benefits all citizens. (Source: https://digitalregulation.org)

- The United Nations has proposed the Global Digital Compact, a global framework for digital cooperation and governance of digital technologies and artificial intelligence, on 22 September 2024. While non-binding, the compact aims to ensure that digital technologies are used responsibly and benefit all, addressing the digital divide and fostering a safe and inclusive digital environment. (Source: https://www.un.org)

What are the Popular Digital Ad Platforms?

| Platforms | Features | Ad Formats |

| Google Ads |

|

|

| DemandSage |

|

|

| Facebook Ads |

|

|

| Instagram Ads |

|

|

| LinkedIn Ads |

|

|

➤ Get the Full Report @ https://www.precedenceresearch.com/digital-ad-spending-market

Digital Ad Spending Market Trends

- Shift to Mobile-First Advertising: Increasing smartphone usage drives advertisers to prioritize mobile-optimized ads, leveraging formats like video, stories, and in-app ads.

- Growth of Programmatic Advertising: Automated, data-driven ad buying is expanding, allowing brands to target audiences more precisely and efficiently in real-time.

- Rise of Video and Streaming Ads: Video content consumption is booming, leading to higher investments in video ads across platforms like YouTube, TikTok, and streaming services.

- Focus on Privacy and Data Regulations: With stricter privacy laws (e.g., GDPR, CCPA), advertisers are adapting by using first-party data and contextual targeting instead of third-party cookies.

- Expansion of Social Commerce Advertising: Integration of shopping features within social media platforms is fueling ad spend as brands target consumers directly through shoppable posts and live streams.

Case Study: How a Global Retail Brand Transformed Growth with Video and Mobile Ads

Background:

A leading international retail brand, with both brick-and-mortar and e-commerce operations, faced declining engagement from traditional display ads. The company needed a scalable strategy to capture the attention of younger, mobile-first consumers while improving conversion efficiency.

Challenge:

- High customer acquisition cost (CAC) through legacy banner and static image ads.

- Limited attribution clarity due to tightening privacy laws (GDPR/CCPA).

- Rising competition from direct-to-consumer (D2C) players aggressively leveraging social platforms.

Strategy:

- Video-First Advertising: The brand reallocated 35% of its digital ad budget from static banners to short-form video ads across YouTube, Instagram Reels, and TikTok. These videos highlighted product usage, customer testimonials, and seasonal campaigns.

- Mobile-Centric Approach: With over 70% of its audience accessing platforms via smartphones, the company built mobile-optimized creatives—vertical video, one-click shop buttons, and interactive polls.

- AI-Powered Targeting: Leveraging Google Performance Max and Meta AI-driven targeting, the brand used first-party data from loyalty apps and purchase history to build precise audience clusters.

- Cross-Platform Measurement: The team employed multi-touch attribution (MTA) models to capture incremental lift, blending insights from social platforms, CTV, and marketplace ads.

Results (12 months):

- +42% increase in online sales attributed to digital ads.

- –29% reduction in CAC due to better targeting and creative personalization.

- +55% uplift in video ad engagement compared to static image ads.

- 10% increase in repeat purchase rate through retargeting campaigns.

- Overall digital ad ROI grew by 1.8×, positioning the brand as a leader in mobile-first retail marketing.

Takeaway:

This case highlights how video + mobile + AI targeting can deliver not only engagement but also measurable bottom-line growth. It demonstrates the shift from traditional digital ads to immersive, performance-driven formats, validating why retail remains the largest end-user segment in the global digital ad spending market.

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Digital Ad Spending Market Opportunity

What is the Opportunity for Market?

Growing Popularity of Social Media Unlocks Market Opportunity

The growing popularity of social media in various regions increases the adoption of digital ad spending. The growing availability of various social media platforms like Instagram, Facebook, LinkedIn, and many more increases demand for digital ads. The growing young population and increasing spending time on social media platforms lead to a higher demand for digital ads.

The increasing penetration of smartphones and the high availability of the internet increase the utilization of social media. The growing trend of influencer marketing and focus on direct consumer interaction increases the utilization of social media. The availability of direct messages, comments, and likes on social media increases the development of personalised digital ads. The growing popularity of social media creates an opportunity for the growth of the market.

Limitations and Challenges in the Digital Ad Spending Market

What is the Limitation of the Market?

High Development Cost Limits Expansion of the Market

With several benefits of digital ad spending in various industries, the high development cost restricts the market growth. Factors like integration with advanced platforms, development of higher-quality content, need for skilled talent, high investment in software & hardware, managing social media, and need for personalised campaigns are responsible for high development cost.

The complexity of campaigns like personalised messaging and multi-platform content increases the cost. The development of high-quality content, such as interactive content, video, and graphics, requires a high cost. The need for specialized tools and the need for advanced platforms increase the cost. The high platform fees of various platforms and the need for specialized talent like content creators, SEO optimizers, & data analysts increase the cost. The high development cost hampers the growth of the market.

Digital Ad Spending Market Coverage

| Report Attributes | Statistics |

| Market Size in 2024 | USD 600 Billion |

| Market Size in 2025 | USD 650 Billion |

| Market Size in 2031 | USD 1,140 Billion |

| Market Size by 2034 | USD 1,483 Billion |

| Growth Rate 2025 to 2034 | CAGR of 50.14% |

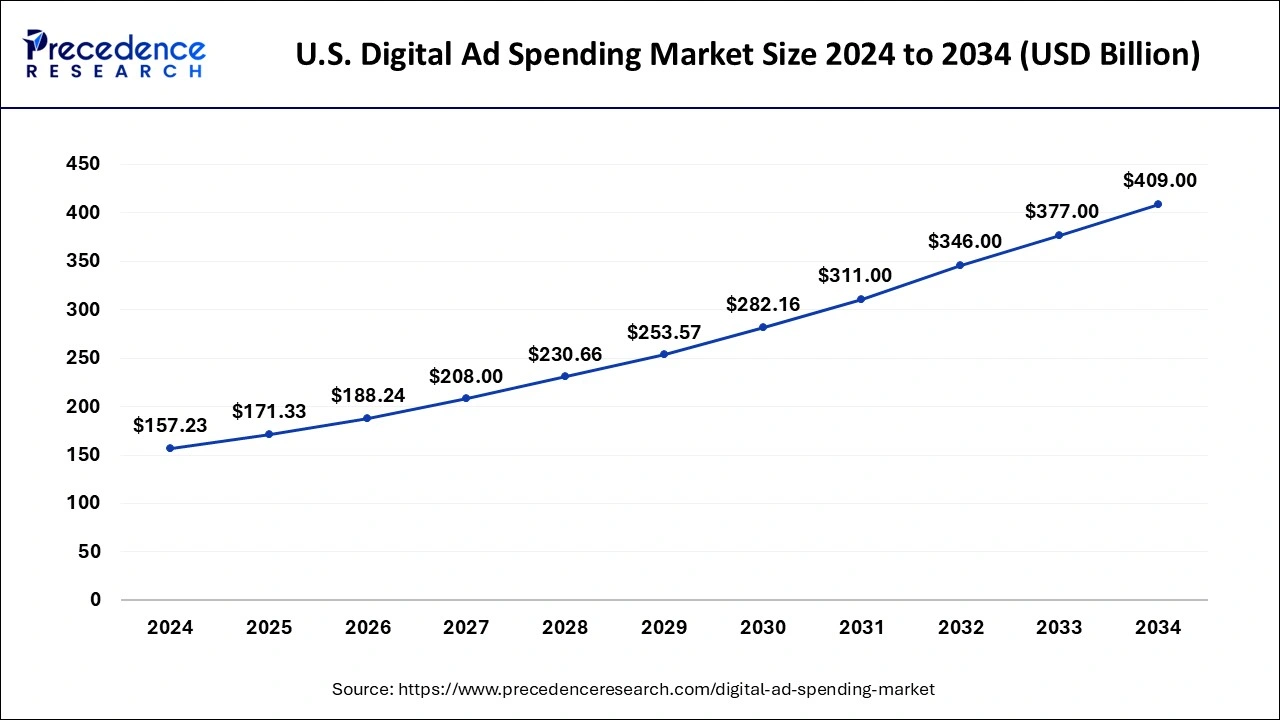

| U.S. Market Size in 2025 | USD 171.33 Billion |

| U.S. Market Size by 2034 | USD 409 Billion |

| Leading Region in 2024 | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Add Format, Platform Used, End User, and Region |

| Regional Scope | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

| Key Players Covered | Alibaba Group Holdings Limited, Google LLC, Baidu Inc, Amazon Web Services, Inc, International Business Machines Corp, Verizon Communications Inc, Facebook Inc, Twitter Inc, Hulu LLC, Microsoft corporation, and Others |

➡️ Become a valued research partner with us ☎ https://www.precedenceresearch.com/schedule-meeting

Digital Ad Spending Market Regional Insights

How Big is the U.S. Digital Ad Spending Market?

The U.S. digital ad spending market size is calculated at USD 171.33 billion in 2025 and is predicted to exceed over USD 409 billion by 2034, with a solid CAGR of 10.03% from 2025 to 2034.

The Complete Study is Immediately Accessible | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1749

How North America Dominated the Digital Ad Spending Market?

North America dominated the market in 2024. The presence of advanced digital infrastructure and high internet penetration increases demand for digital ad spending. The increasing adoption of smartphones and the popularity of e-commerce are increasing the adoption of digital ad spending. The growing popularity of streaming services like TikTok & YouTube, and the growth in OTT & CTV platforms, increases demand for digital ad spending. The presence of key players like Meta and Google drives the market growth.

The U.S. is a major player in the regional market due to its large and mature digital economy, advanced technological infrastructure, and high internet penetration rates. With a vast population of digitally savvy consumers and businesses, the U.S. offers advertisers a wide-reaching and diverse audience, making digital channels highly effective for marketing. Additionally, the presence of global tech giants like Google, Facebook (Meta), Amazon, and Microsoft headquartered in the U.S. drives innovation and competition, leading to sophisticated advertising platforms and tools that attract substantial ad budgets.

Which Region is Experiencing the Fastest Growth in the Digital Ad Spending Market?

Asia Pacific is experiencing the fastest growth in the market during the forecast period. The growing adoption of smartphones and high penetration of the internet increases demand for digital Ad spending. The high investment in mobile-focused advertising helps market growth. The rise in retail media and the increasing popularity of social media increase demand for digital ad spending. The booming e-commerce platforms like Flipkart & Shopee, and the growth in social commerce platforms like WeChat, TikTok, & Instagram support the overall growth of the market.

China is leading the regional market due to its massive internet user base, the largest in the world, and rapid digitalization across urban and rural areas. The country’s strong e-commerce growth, fueled by platforms like Alibaba and JD.com, creates vast opportunities for advertisers to reach highly engaged consumers. The government’s supportive policies for digital infrastructure and technology innovation, combined with growing investments from both domestic and international companies, further accelerate China’s dominance in the region’s digital advertising landscape.

Digital Ad Spending Market Segmentation Analysis

Add Format Analysis

Why did Video Segment Dominate the Digital Ad Spending Market?

The video segment dominated the market in 2024. The growing availability of social media and streaming platforms increases demand for video ads. The growing consumption of video content and the adoption of mobile devices help the market growth. The growing consumer preference for short videos and the rise in OTT & CTV increase demand for video ads. The focus on immersive experiences and advancements in video ads drives the overall growth of the market.

The social media ad format segment is expected to grow fastest over the forecast period in the market because social media platforms offer highly targeted, engaging, and interactive advertising opportunities that effectively reach diverse and large audiences. Their advanced data analytics and user behavior tracking enable advertisers to personalize ads, improving conversion rates and return on investment. Additionally, the widespread use of smartphones and the growing time users spend on social media amplify ad visibility, making social media ads more cost-effective and impactful compared to traditional digital ad formats.

Platform Used Analysis

How the Mobile Segment Held the Largest Share in the Digital Ad Spending Market?

The mobile segment held the largest share in the market in 2024. The growing availability of content like entertainment, social media, and news on mobiles helps market growth. The increasing consumption of content and popularity of short-form video increases the adoption of smartphones. The focus on immersive formats like video streaming, social media, & gaming, and the need for personalized experiences, increases the adoption of smartphones, driving the overall growth of the market.

The laptop platform segment is the second-largest segment, leading the market, because laptops combine portability with powerful performance, making them a primary device for work, entertainment, and online shopping—all key activities where users engage with digital ads. Their widespread use among professionals, students, and everyday consumers leads to higher screen time and richer interaction with multimedia content, increasing ad visibility and effectiveness. Moreover, laptops support a broad range of ad formats, from video to interactive ads, providing advertisers with versatile opportunities to target and engage audiences more efficiently than on smaller mobile devices or less-used desktops.

End User Analysis

Which End-User Industry Dominated the Digital Ad Spending Market?

The retail segment dominated the market in 2024. The availability of customer purchase behavior and focus on personalization increases demand for retail. The growing awareness about direct communication and growth in retail media platforms like apps & websites helps the market growth. The strong focus of retail on enhancing customer experience through virtual store experiences and providing tailored recommendations drives the overall growth of the market.

The education segment is the fastest-growing in the market during the forecast period. The high penetration of the internet and the growth in digital education platforms help the market growth. The growing availability of information on digital platforms and the growing popularity of online education help the market growth. The strong focus on reskilling & upskilling and increased utilization of social media, search engines, and school websites support the overall growth of the market.

Digital Ad Spending Market Top Companies

- Alibaba Group Holdings Limited - Alibaba offers a vast e-commerce ecosystem along with cloud computing, digital media, and AI-driven advertising solutions tailored for global markets.

- Google LLC - Google provides comprehensive digital advertising platforms, including Google Ads, search engine marketing, video ads on YouTube, and advanced data analytics.

- Baidu Inc. - Baidu specializes in Chinese-language search engine services and offers AI-powered advertising and cloud services focusing on the Asia-Pacific region.

- Amazon Web Services, Inc. - AWS delivers scalable cloud computing services and data-driven advertising tools, enabling businesses to optimize digital marketing campaigns.

- International Business Machines Corp (IBM) - IBM offers AI-powered marketing analytics and cloud-based solutions to enhance customer engagement and automate ad targeting strategies.

- Verizon Communications Inc. - Verizon provides telecommunications infrastructure combined with digital media and advertising services through its platforms, such as Verizon Media.

- Facebook Inc. - Facebook (now Meta) offers highly targeted social media advertising across its platforms, including Facebook, Instagram, and WhatsApp, leveraging vast user data.

- Twitter Inc. – Delivers real-time social media advertising solutions that focus on engagement and trend-driven marketing for brands and businesses.

- Hulu LLC - Hulu offers premium video streaming services with targeted advertising options integrated into its content for a highly engaged audience.

- Microsoft Corporation - Microsoft provides digital advertising solutions via LinkedIn and Bing Ads, along with AI and cloud technologies to improve ad performance and reach.

Digital Ad Spending Market Recent Developments

- In July 2025, Nielsen launched CTV ad spend data into UK ad Intel. It offers a view of platforms like Disney+, My5, Now, Sky, U amongst others, Prime Video, ITVX, Netflix, Freeview, and Tubi. It helps optimize media strategies, making smarter decisions, and benchmarking performance. (Source: https://www.advanced-television.com)

- In July 2025, Pearl Media launched an eye-level OOH ad network in New York. The network consists of 40 large-format digital LEDs, and the screens are 100% full motion. The screen is 96 square feet, and it offers an additional revenue stream to property owners. (Source: https://www.digitalsignagetoday.com)

Digital Ad Spending Market Segments Covered in the Report

By Add Format

- Social media

- Video

- Search Engine

By Platform Used

- Mobile

- Laptop

- Desktop

By End User

- Retail

- Health care

- Automotive

- Media and entertainment

- Education

- Transport and tourism

- IT and telecom

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1749

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

Stay Ahead with Precedence Research Subscriptions

Unlock exclusive access to powerful market intelligence, real-time data, and forward-looking insights, tailored to your business. From trend tracking to competitive analysis, our subscription plans keep you informed, agile, and ahead of the curve.

Browse Our Subscription Plans@ https://www.precedenceresearch.com/get-a-subscription

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Trusted Data Partners:

Towards Healthcare | Towards Packaging | Towards Automotive | Towards Chem and Materials | Towards FnB | Towards Consumer Goods | Statifacts | Towards EV Solutions | Towards Dental | Nova One Advisor | Market Stats Insight

Get Recent News:

https://www.precedenceresearch.com/news

For the Latest Update Follow Us:

LinkedIn | Medium | Facebook | Twitter

✚ Related Topics You May Find Useful:

➡️ Smart Advertising Services Market: Discover how AI-driven platforms are transforming targeted campaigns and ROI optimization

➡️ Digital Transformation Market: Explore how enterprises are leveraging cloud, AI, and automation to reshape business models

➡️ AdTech Market: Understand how programmatic, data-driven, and privacy-first tools are redefining advertising strategies

➡️ Television Advertising Market: Track how connected TV and streaming platforms are reshaping traditional ad spending

➡️ Display Market: Examine how OLED, microLED, and flexible screens are driving next-gen consumer and industrial applications

➡️ AI in Social Media Market: Learn how generative AI and analytics are powering engagement, personalization, and content creation

➡️ Artificial Intelligence in E-commerce Market: See how AI is enabling predictive recommendations, chatbots, and hyper-personalized shopping

➡️ Digital Biomarkers Market: Analyze how wearables and mobile health apps are redefining clinical trials and patient monitoring

➡️ Social Commerce Market: Explore how social platforms are blending shopping with content to create new revenue streams

➡️ Email Encryption Software Market: Gain insights into how enterprises secure communication against phishing and cyber threats

➡️ Online Books Market: Assess how e-books, audiobooks, and subscription platforms are reshaping reading habits globally

➡️ Content Intelligence Market: Discover how AI-driven insights are optimizing content creation, strategy, and distribution

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.